Online Tax Prep: What You Need to Know

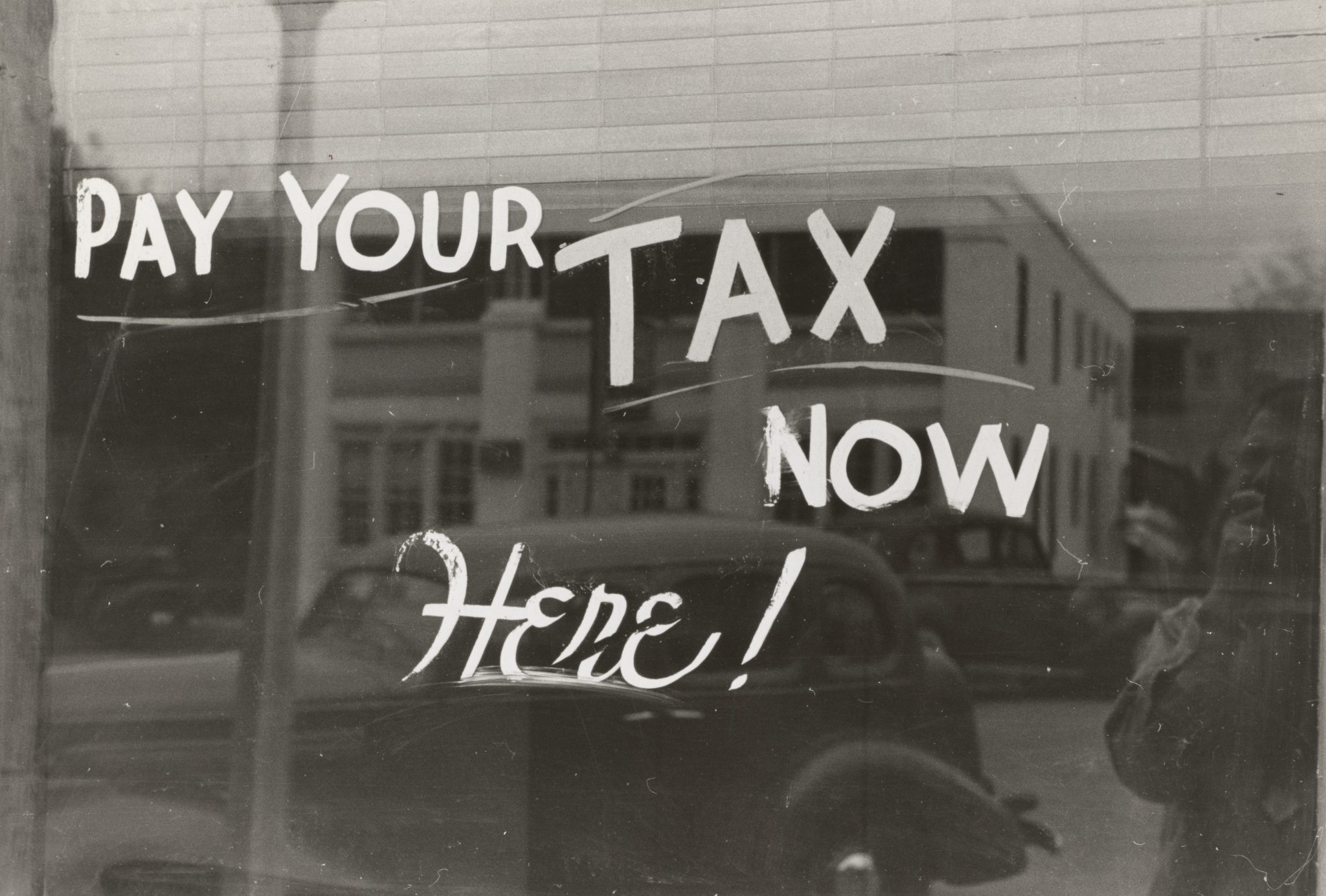

Every year, people in the United States must file their tax returns with the Internal Revenue Service. Once upon a time, people lined up to bring their returns to a post office before midnight on the filing deadline on April 15.

Table of Contents

Every year, people in the United States must file their tax returns with the Internal Revenue Service. Once upon a time, people lined up to bring their returns to a post office before midnight on the filing deadline on April 15.

Today, most people file their taxes online. In fact, 92% of all tax returns were filed online in 2018, and that percentage is expected to continue to grow. Online tax prep has become the way to do your taxes.

And honestly? We’re pretty happy about it.

You might be wondering why, exactly, we are psyched about online tax prep? For one thing, it allows you to do everything at home. Software programs make it easier for people to go through their tax forms and understand their income. Most tax prep options are designed to help people interact with simple questions rather than complicated forms.

Read more: The 7 Best Tax Services Online

However, typical online options may not be fully sufficient to deal with the tax concerns of people with small businesses, freelance income, rental income, cryptocurrency investments and other complexities. All of these may inspire people to seek the help of a professional, and we totally get that.

Thankfully, there are also awesome online accountant services now. These allow you to upload your forms and get help from a real live person, making your taxes easy, digestible and straightforward.

What is Online Tax Prep?

There are a bunch of online options available for filing taxes online. Most of these services assist people in completing their own tax returns and submitting them through the IRS’ efile system.

People handle their taxes at home on the internet, rather than going to a tax professional’s offices. When you receive your tax refunds via direct deposit, the entire tax process can be handled without leaving your house.

Some might download desktop software to prepare their taxes, while others use web-based services to manage your data. Regardless of which option you choose, the program will ask you questions in order to help you complete the tax forms.

Online tax preparation services have free versions but almost everyone ends up having to pay for the software.

Online tax prep software uses the answers you provide to determine any relevant deductions and tax savings that fit your unique profile. In some cases, you can upload your W-2s, 1099s and other forms directly into the software by taking a photo with your mobile phone.

Keep in mind, even when using an online tax preparation service, you are fully responsible for the declarations you make to the IRS about your income, expenses and deductions. In some cases, you can sign up for audit protection services to give you some form of representation if your return is selected for audit.

Online Tax Prep Services Available

While many different online tax prep services are available, most of these tax software options are still DIY (i.e. you are doing your own taxes, assisted by the software). We’ll talk more later about online accountants, which can bring a personalized, expert approach to managing your taxes online.

Some of the most widely known online tax tax prep services include the following:

- TurboTax

- Tax Act

- H&R Block Online

- Tax Slayer

- Jackson Hewitt

In almost all cases, the software will take you through a series of questions. It will then analyze your responses to determine which deductions or credits you might be eligible for. For example, if you include that you own a home or pay a mortgage, the system will ask you about energy improvements that could give you a tax credit.

Many people like to file their taxes online because they want to be fully in control of their tax documents, but the software makes it much easier than filling out the forms by hand the old way. In addition, the process is much faster than it was before online options existed.

Online Accountants vs. Online Tax Services

We’ve established that the legacy online tax prep options can be great for people with relatively simple, straightforward needs and who meet the income qualification guidelines. With the rise of the gig economy and the growth of tech startups, however, many people have more complex sources of income.

They may have self-employment income, rent out a house they own or even just receive Social Security benefits.

An online accountant is a different option that can provide people with the benefits of an in-person CPA along with the convenience of online tax preparation.

Most online tax options are software programs that help you to do your taxes yourself. You still need to understand how to handle the different types of income that you have and the credits or deductions you can claim, and you can still easily spend hours or longer completing your tax return.

Working with an online accountant means that you spend only minutes dealing with your taxes by answering a few simple questions and uploading all of your relevant documents, receipts and forms. A specially screened accountant will complete all of your tax forms for you. Once you have approved the results, your online accountant can efile them directly with the IRS.

Like an offline accountant, your online CPA can provide you with guidance on tax savings and strategies to help you save and maximize your tax refund.

Conclusion

The online tax prep market continues to evolve with online tax accountants becoming increasingly important. An online tax accountant can be a great solution for anyone who is uncomfortable with or does not want to spend the time to complete their tax forms themselves. For people with complex income flows, business ownership, freelance work or international income, an online tax accountant can simplify the process tremendously.

Picnic Tax is an excellent option for people who need the expertise and personal touch of an accountant along with the benefits and time savings of online filing. In addition, you’ll know what you pay from the very beginning, with Picnic’s easy, fixed-rate pricing. You don’t pay until your accountant prepares your returns, and your accountant will file your tax returns on your behalf with the IRS.

Give Picnic Tax a try today to experience the latest evolution in online tax services!